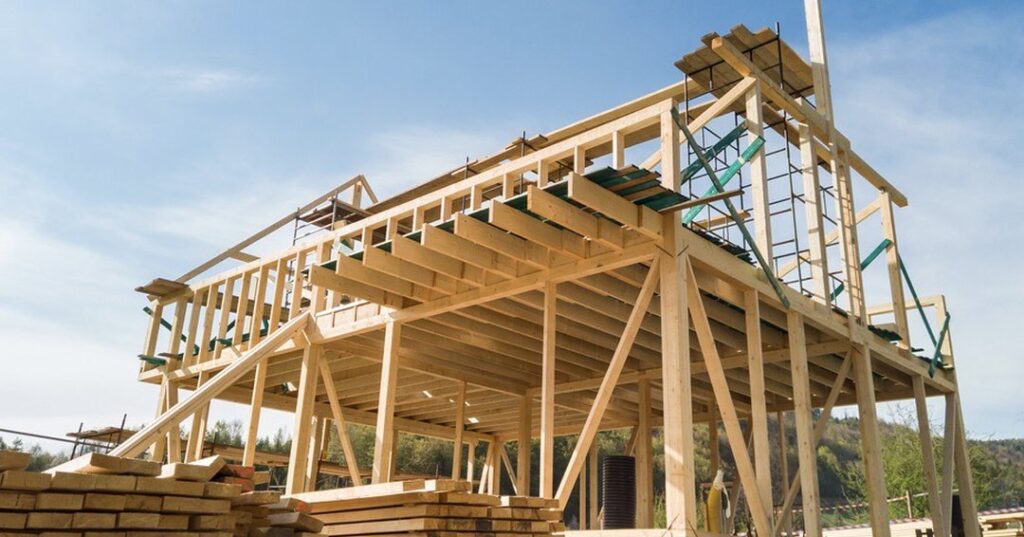

CIBC: Housing deficiencies linked to undercounted demand Even though interest rates are moving higher, some economists think that a change in rates won’t have much of an impact on the housing market until something is done to address Canada’s chronic supply issue. This is because interest rates are negatively correlated with home prices. Benjamin Tal, managing director and deputy chief economist at CIBC Capital Markets, and Katherine Judge, director, and senior economist at CIBC Capital Markets, recently collaborated on a new article for In Focus with CIBC Capital Markets in which they explained why an increase in interest rates might not necessarily help the struggling housing market. There has already been a reaction in the market as a result of increasing borrowing costs; nonetheless, this will not solve the problems associated with housing affordability. Instead, a pause in market activity may simply alleviate symptoms or “worsen the supply-demand imbalance in the market.” “Entering a more relaxed housing environment should not ease the urgency in which the chronic lack of housing supply in the Canadian market is dealt with,” said the In Focus report. “After years of fighting supply issues using demand tools, governments at all levels finally recognize that over time, the housing affordability crisis will worsen without adequate supply policies.” The question then is, what causes the problem with the supply? Both Tal and Judge pointed the finger at the faulty methodology that was used to formulate housing policy as well as the industry’s inability to satisfy provincial and federal housing goals as a part of the problem. Comparison of Canadian Housing to others Comparison of Canadian housing performance to other countries is an overly simplistic method to use when attempting to evaluate the state of the housing market in Canada. A comparison between the housing stock and the population is typically done using the database maintained by the Organization for Economic Co-operation and Development (OECD), which is used in order to present a picture of the housing supply difficulties that Canada faces on an international scale. Comparing Canada to other countries was the approach that was taken for the drafting of the federal budget for 2022. This comparison, on the other hand, is susceptible to oversimplification due to the fact that variations in household formation and demographics can cloud its conclusions. According to the economists working with CIBC, “Furthermore, taking housing stock as a share of the population doesn’t account for differences in demographics or cultural preferences that shape household sizes or formation rates.” “Nor does it account for the different propensity to rent, as countries with higher shares of renters generally have more abundant housing supply.” the report states. Even when the housing market in Canada is compared to that in the United States, the results may not be realistic. According to Judge and Tal, both countries have housing stock that is comparable when measured against the norms of the OECD. However, this does not explain why property prices in Canada have increased at a rate that is twice as fast as those in the United States during the previous 20 years. According to the reports, “These shortcomings of international comparisons suggest that it’s more informative to look at Canada’s housing market in isolation to determine what’s behind the market’s imbalance” Inadequate picture of demands due to undercounting of households Tal and Judge highlighted that household formation is the most important element to evaluate when it comes to estimating the demand for housing; yet, the statistics that they provide are typically not correct. The Canadian Mortgage and Housing Corporation (CMHC) collects data on household formation by converting population growth into the number of households using the quality of households formed from a given number of individuals and then translating that number back into population growth. On the other hand, some information is being lost in the translation, which is leading to a “gross underestimate of the real number of households in Canada, and thus demand for housing.” “And if demand is undercounted, then of course the supply released by municipalities to meet that demand will be inadequate,” explained the report. For instance, the Demographic Division of Statistics Canada counts all individuals whose non-permanent residence visas have expired and who are still in the nation as having departed the country 30 days after their visas have expired. Nevertheless, during the epidemic, non-permanent residents who had expired visas were allowed to stay in the country through extensions. This means that those people are not included in any official figures, despite the fact that they still require housing. In a different example, Tal and Judge said that the estimates done by CMHC assume the same headship rate for new immigrants, non-permanent residents, and long-term residents. According to Tal and Judge’s estimation, the existing need for housing is undercounted by 500,000 households. Limitations imposed on the industry to meet the demands of housing The issue of housing supply in Canada “is serious and needs action” as implied by the undercounting of the demand for homes. Tal and Judge emphasized that although there is no shortage of ideas to generate housing, not enough attention is being paid to the reality that the industry’s means to meet higher housing targets is limited. The rise in the typical amount of time needed to finish a building project is one facet of the problem. “It takes twice as long to complete both low-rise and high-rise units today than it did two decades ago. And a lack of labour supply is a major cause of those delays,” said the report. “While large developers are usually able to secure their own labour pool, that’s not the case for mid-sized and small operators that account for 30 to 40 percent of activity.” Competition for labourers has intensified as a result of large-scale infrastructure projects, an issue that has become even more difficult as a result of shortages imposed by COVID-19. The construction industry did not return to its pre-pandemic employment levels until January 2022. This was a