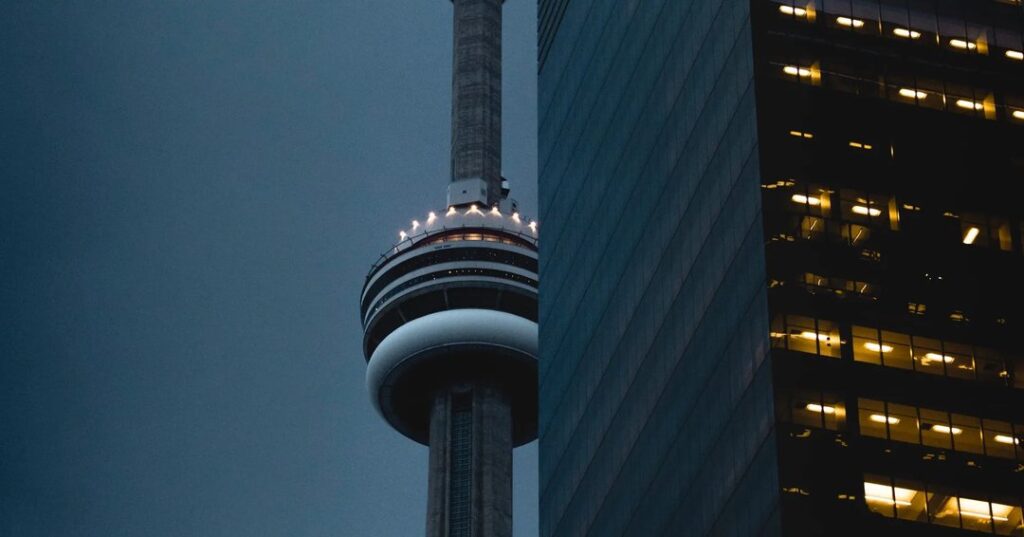

The influence of Toronto’s property market on the rest of Canada

The influence of Toronto’s property market on the rest of Canada Families have been fleeing the Greater Toronto Area (GTA) to places like Kitchener and Woodstock, or even smaller areas in the province, since the middle of the 2010s due to Toronto’s housing crunch. Since people still had to commute to the GTA prior to the pandemic, this phenomenon was confined to an area within 100 kilometres. There has been a significant increase in the number of families relocating to Alberta and Atlantic Canada as distant work has become the norm. Since the pandemic began, the population of Nova Scotia has nearly quadrupled as 8,166 Ontarians have relocated there between 2019 and 2020, and another 15,862 are expected to do so in 2021 and 2022. In the same time period, the number of Ontarian emigrants to Alberta increased from 14,550 to 29,422. As an additional note, this is the first year since 2014 in which the influx of Ontarians into Alberta has outweighed the outflow of Albertans into Ontario. As a result of the migration, housing costs in the Greater Toronto Area (GTA) and the rest of Southern Ontario have risen at an alarming rate in recent years. For example, in Kitchener-Waterloo, where price increases began to be seen, the benchmark price of a single-family home in April 2017 was $518,900, up 35% from the previous year’s $381,700. The Canadian Real Estate Association reports that home prices in Halifax have increased by 15% over the past year, from an average of $434,700 in September 2021 to $499,900 in September 2022. The truth is that even a relatively small influx of families into rural Nova Scotia or Prince Edward Island can have a significant impact on the property market there. Communities all around Canada need to get ready for the impact of what we saw in Southern Ontario, a phenomenon I call the “Great Canadian Convergence.” About 75,000 people have moved out of the Greater Toronto Area, the York Region, and the Peel Region in the past year. Larger effects on the region can be expected as a result of rising housing prices outside of the Greater Toronto Area. If young Torontonians can’t afford to buy homes in the city, where will the next generation of educators, healthcare professionals, and tradespeople live? What plans does the region have to reduce the gap between the wealthy and everyone else? More house construction is the ultimate answer. More families can be kept in the Greater Toronto Area if more affordable housing is built there. Each of the four major parties in Ontario’s previous election promised to work toward a goal of 1.5 million new houses in the province over the next decade. We need to figure out how to recruit enough trained labour to build these dwellings and how to adjust zoning restrictions to boost density. Meanwhile, the trend of families fleeing the Greater Toronto Area has had some good effects on Ontario towns, with the migration to smaller centres sparking rehabilitation efforts all around the province. Forty years of effort have gone into finding ways for rural Ontario communities to maintain their educational systems; now, with an influx of new students, several of these schools are obtaining portables. The entire country of Canada is about to go through the same thing. The good news is that. what’s the bad news? There has been a lot of upheaval due to housing costs. Well-off families, many of whom work for Toronto-based companies but live elsewhere, drive up housing costs for the rest of the population. Many people, including some who responded to my initial tweets about the Great Canadian Convergence, have suggested that encouraging workers to return to the office will help to reverse this trend. That’s a big if in my book. Especially in light of the current labour scarcity, it will be challenging for employers to insist on in-person employment: “If I can’t work remotely for you, I’ll go remote for someone else.” Businesses and cultural institutions in Canada’s smaller cities and towns have a great chance to thrive thanks to the Great Canadian Convergence, which will also lead to the creation of additional jobs. However, cities must prepare for the arrival of new families if they want to avoid housing shortages and rising prices. Duplexes and triplexes can be built in areas where zoning restrictions are less stringent, and the conversion of the unused shop and office space into housing is also helpful. For instance, in Calgary, a former office building has been transformed into eighty-two units of low-cost housing, while in Ontario, a new law has been introduced that would permit the construction of three dwellings on the site of a single-family home. When the population increases more quickly than expected, cities might run into trouble. The city of Ottawa has set a 10-year housing target of 75,839 in its official plan. But the Smart Prosperity Institute has found that by 2031, Ottawa will require more than 100,000 new dwellings to accommodate its growing population. There is a growing population in Ottawa, but not enough homes to accommodate them; 5,500 individuals left the city for the counties surrounding it in 2021, up from 400 persons in 2015. A growing number of people are relocating to smaller communities like Carleton Place, located just 40 minutes south of Ottawa, in order to work there. That leads to sprawl, pollution, and extra infrastructure construction for the city of Ottawa at no additional cost. While the Great Canadian Convergence has the potential to revitalise communities across the country, doing so without proper planning could drive up housing costs for locals and exacerbate income disparities. It would be a good idea for the mayors of Alberta and Atlantic Canada to pay a visit to these Ontario communities that have recently seen a population boom. Speak with the natives. Find out what has altered and what they have discovered as a result. Related posts. How does a home warranty differ from an insurance policy? Read

The influence of Toronto’s property market on the rest of Canada Read More »