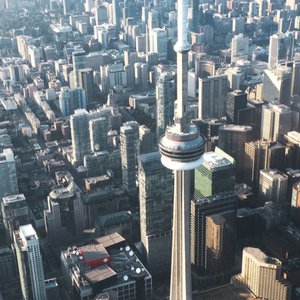

Toronto and Durham properties continue to be purchased by Minto Minto Communities GTA has added two additional development sites to its portfolio this year, bringing its total to four in the Greater Toronto Area. Toronto and Durham Region are the two most recent locations. Since 2018, Minto Communities GTA has introduced 9 projects totaling over 4,000 units, with 2.5 million sq . ft of planned high-rise construction and over 130 acres of proposed low-rise development. As per Minto Communities GTA vice-president of urban development and acquisitions Jeff O’Reilly, there would be more to follow. “We’re very selective about the places where we choose to build. We’re proud builders and we want to continue to grow our portfolio with a continued eye to quality locations and quality projects,” O’Reilly told RENX. The financial specifics of the four most recent acquisitions have not been revealed. Minto Group is a family-owned and operated fully integrated real estate development, construction, and management firm with offices in Ottawa, Toronto, Calgary, and South Florida. To date, it has designed and built over 95,000 houses. Mimico acquisition Minto’s newest acquisition is located at Grand Avenue and Portland Street, only steps from the Mimico GO Transit station, and builds on years of operations in Etobicoke. The 5.5-acre property is designated for 1.08 million square feet and will be developed into a high-rise, master-planned community with three condominium buildings totaling 1,260 units, ground-floor shops, and a public park. The land is now occupied by a number of vacant industrial and commercial structures that have remained unoccupied for some years. They’ll be demolished to make space for the new development. “The Mimico site is a perfect fit for our urban portfolio,” said O’Reilly. “It’s got the scale and it’s got the locational attributes we’re attracted to. This location and Minto’s acquisition of the multi-tower Danforth Village development site in 2020 have a number of parallels. In the east end of Toronto, at 9-25 Dawes Rd., the Danforth site is also part of a proposed master-planned, high-density node surrounding GO and Toronto Transit Commission stations. Parkdale acquisition Minto has also closed on a conditionally designated 0.4-acre site at 6 Noble St. in Toronto’s downtown west Parkdale area, which is now owned by a derelict commercial and industrial structure. Minto intends to construct an eight-story boutique condo that will blend into the cityscape of the diversified and gentrifying neighbourhood, which is home to a variety of artisan small shops, eateries, and bars. “We saw the opportunity to build an urban gem nestled in a strong community,” said O’Reilly. “It’s a rare product for us. It’s a boutique eight-storey mid-rise building filled into a neighbourhood. We’ve got the two-storey product on the ground floor to provide street presence and we’ve got the three-storey product on the top as well.” Brooklin acquisition Minto, which already has finished and active communities in the fast-rising Durham Region, has bought a 27-acre greenfield property in Brooklin, northeast of Toronto, near the northwestern side of Columbus Road & Baldwin Street North. There seem to be initial plans for 190 new single-family, traditional townhouse, and rear-lane townhome units to be built inside a pedestrian-friendly neighbourhood with a network of walking routes, parks, and greeneries. “There’s something special about Brooklin when you spend time strolling around the historic downtown village or one of the trails or the green spaces and parks,” said O’Reilly. O’Reilly is optimistic that the technology will be commercialised within the next few years. Courtice acquisition The Courtice settlement of Clarington is located on Courtice Road north of Bloor Street, which is Minto’s other recent Durham Region acquisition. The low-rise neighbourhood will have single-family houses, traditional townhomes, and rear-lane townhomes on a 100-acre greenfield site northeast of Toronto. “This gives us an opportunity to be a part of the growth in Durham,” said O’Reilly. “This is a great location. We see the future here and we see the possibilities to build something special in a great place to live.” Walking paths, parks, and lots of natural landscapes will all be part of the project’s wellness-oriented community facilities. Other Minto developments in Toronto. The ninth storey of 123 Portland, a high-end 14-story, 117-unit condo on Adelaide Street West and Portland Street in downtown Toronto, has been completed. According to O’Reilly, there aren’t many units remaining for sale. This April, the last suites will be accessible. At The Saint, six levels of subterranean parking have been finished, and work is currently at grade and moving upward. At the junction of Adelaide Street East and Church Street in downtown Toronto, the 47-story, 418-unit condo complex is located. Other Minto developments from around GTA North Oak Condos at Oakvillage, a 20-story, 374-unit condo at Dundas Street East and Trafalgar Road in Oakville, has sold out of its first allocation of units. Work on an energy-efficient geo-exchange heating and cooling system will start next month, according to O’Reilly, with the second delivery of units coming this spring. At Harmony Road, North and Winchester Road East in North Oshawa, The Heights of Harmony is a master-planned single-family and townhome development. The first batch of houses has been sold out, and also the second batch will be available in the fall. As per O’Reilly, site maintenance should begin this year. Union Village, a master-planned single-family and townhome development in Markham north of 16th Avenue and Kennedy Road, had also sold out its first two phases. The first phase of building, according to O’Reilly, is well underway, and further stages will be made available for purchase in the future. Related posts. Toronto and Durham properties continue to be purchased by Minto by admin123 With Canadian Bond yields reaching 2018 levels, the buyers can expect higher mortgage by admin123 More options available for the buyers while prices are breaking records by admin123 Supply fixing Canadian Real estate seems a tiny solution to the heap of problems by admin123 Is the Housing Market Going to Cool Down in 2022? by admin123 Know why the real